January 29, 2015

A 2009 GFOA white paper identified long-term financial planning as the central tool for local governments to become financially resilient. Financial resiliency is characterized by going beyond just financial sustainability to a system that is adaptive and able to sustain external shocks such as an economic downturn.[1] Credit rating agencies have also recognized the importance of long-term financial planning. As such, the Civic Federation frequently recommends in its budget analyses that local governments undertake long-term financial forecasting and planning.

Several local governments the Civic Federation analyzes have taken steps toward the creation of a publicly shared long-term financial plan by publishing long-term financial projections, but the MWRD was one of the first to publicly report its use of these financial planning techniques. The Civic Federation has praised these planning efforts in our analyses of the MWRD’s budgets since FY2007. MWRD has not yet developed and shared publicly a full long-term financial plan with a discussion of financial imbalance scenarios and options to overcome them. However, the District is an example of a forward thinking government that has strong capital planning efforts and has implemented strategies to overcome large pension and retiree healthcare obligations.

In the FY2015 MWRD Budget, the District continued to utilize long term planning techniques, including:

• A five-year financial forecast for revenues, expenditures, personnel and tax rates;

• A new Strategic Business Plan for FY2015 and beyond; and

• A best practice Capital Improvement Plan that includes narrative descriptions of capital projects, justifications for projects and descriptions of their impact, project costs, maps that show project locations, line item analyses of appropriations and expenditures and an analysis of projects’ personnel requirements.

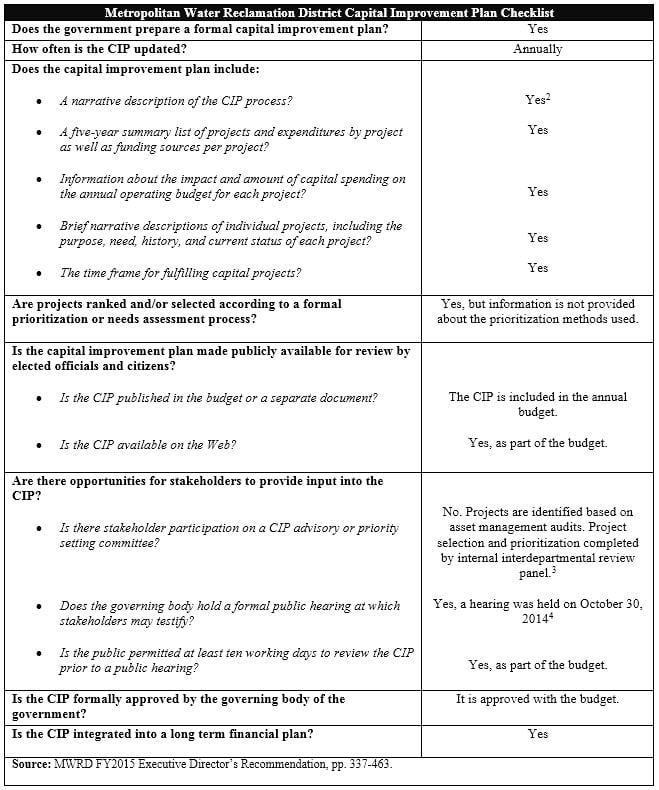

As can be seen in the table below, the MWRD meets almost all of the best practice guidelines for a capital improvement plan. Its CIP is included in the budget and available on the District’s website. The CIP includes a comprehensive list of ongoing projects and new proposed projects for the next five years, the timeframe for completing those projects and summary financial information. A narrative description is provided that briefly describes the CIP process. Projects are identified and ranked using a formal needs-based prioritization process. However, that process is not described in the CIP document and the prioritization process is internal, excluding input from external stakeholders.

The MWRD also reached an important milestone recently with its retiree healthcare trust, which prefunds other post employment benefits (OPEB) through a trust fund started in 2007. The Board of Commissioners established the trust with a policy target of reaching a 50% funded ratio in 50 years, and requiring a $10 million contribution from the Corporate Fund in each of the first five years. The trust was initially seeded with $15 million. Through additional contributions in the years following, the District met its goal of $50 million total contributed through 2011. The Trust then reached a 50% funding level in 2014.[2] This funding level exceeds the adopted policy target date of 2050 by 41 years. The Board adopted an updated funding policy for the OPEB fund on October 2, 2014. The funding policy was amended to include a 100% maximum funding level to be achieved in twelve years with a $5 million per year contribution starting in FY2015.[3] The policy also begins to describe how contributions for retiree healthcare will be paid for once the fund reaches the 100% funded goal.

The MWRD was also one of the first Chicago area local governments to present a pension reform package to the Illinois General Assembly. In fall of 2011, the MWRD Retirement Fund Board of Trustees proposed pension funding reforms with support from the MWRD Board of Commissioners. The changes were introduced in the Illinois General Assembly as House Bill 4513 by Representative Elaine Nekritz in January 2012, passed by the Illinois House in March 2012 and by the Senate on May 31, 2012 and were signed into law by Governor Pat Quinn in August 2012. Additionally, following the Retirement Fund actuary’s recommendations, the MWRD Board of Commissioners established a new funding policy because the minimum contribution required under P.A. 97-0894 may not be sufficient to meet that statute’s funding goal of 90% by 2050. The District also took rating agency guidance that addressing the District’s pension liability is essential to its rating stability. The new funding goal of the District is “to contribute annually to the Fund an amount that over time will increase the ratio of Fund assets to accrued liabilities [funded ratio] to 100% by the year 2050.” [4]

The Civic Federation commends the District’s forward thinking planning efforts and particularly its work to create and fund its retiree healthcare trust. The Federation recommends that the General Assembly allow all governments the option to pre-fund their retiree healthcare benefits.

[1] Shayne Kavanagh, “Building a Financially Resilient Government through Long-Term Financial Planning,” Government Finance Officers Association, www.gfoa.org/downloads/financiallyresilientgovernment_whitepaper.pdf (last visited on January 27, 2015).

[2] MWRD FY2015 Executive Director’s Recommendations, p. 1.

[3] MWRD FY2015 Executive Director’s Recommendations, p. 28.

[4] MWRD Presentation: Review of New Accounting Requirements for Pension (GASB 67/68) and Proposed Pension Funding Policy, presented September 18, 2014.